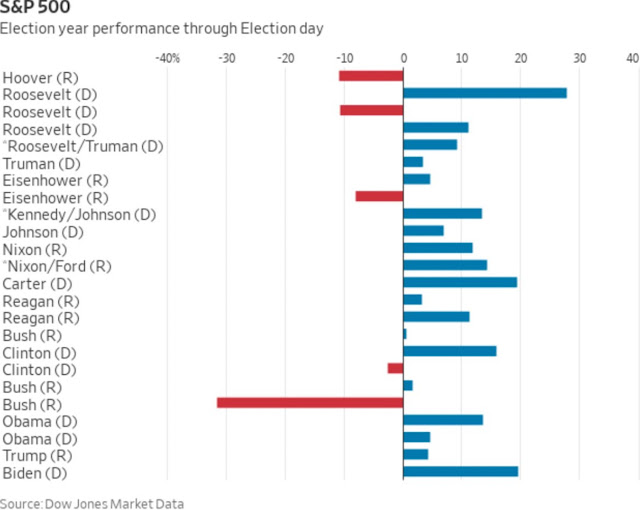

The performance of the stock market during an election year can be a hot topic. Investors, analysts, and even ordinary citizens often speculate about how the outcome of a presidential race might impact their financial future. But is there any truth to this speculation? Can the stock market’s performance during an election year really tell us something about the economy, or even help us predict the outcome? Let's explore this intriguing question using the historical data from the S&P 500 during election years, as shown in the chart below:

Does Party Matter for Market Performance?

The chart above displays the S&P 500's performance in the lead-up to Election Day for different U.S. presidents, both Democratic and Republican, over nearly a century. Interestingly, it reveals no consistent pattern strictly based on party lines. Some election years under Democratic presidents saw significant stock gains, while others under Republican presidents also posted solid performances. For example, Franklin D. Roosevelt, a Democrat, oversaw both massive gains and losses in different terms, while Dwight D. Eisenhower, a Republican, saw modest but steady growth.

So, does the political party in power influence the market directly? It seems not as much as one might think. Rather than party affiliation, economic conditions during the term seem to play a more substantial role in shaping market performance. If the economy is booming, stocks usually perform well regardless of the sitting president’s party. Conversely, if the economy is in trouble, even the most market-friendly policies might not be enough to drive growth.

Economic Conditions and the Market’s Response

To understand these fluctuations better, let’s take a closer look at two economic principles: business cycles and market expectations.

Business Cycles: The economy naturally goes through cycles of expansion (growth) and contraction (recession). If an election falls during a period of economic expansion, the sitting president often enjoys the tailwinds of a booming market. Take, for example, Bill Clinton's years. The stock market saw positive returns in the election years of 1996 and 2000, benefiting from the tech boom and a strong economy. On the other hand, George W. Bush's presidency saw significant drops in the S&P 500 leading into the 2008 election, influenced by the financial crisis, which had little to do with election-specific factors and everything to do with the broader economic downturn.

Market Expectations: Investors try to “price in” the future, including potential policy changes from a new administration. This means that the market’s performance isn’t just about current economic conditions—it’s also about what investors expect the future to hold. For instance, if investors believe that a candidate will bring market-friendly policies, they might start buying stocks, leading to a rise in the S&P 500. Conversely, uncertainty or fears of unfavorable policies could lead to a sell-off.

The Uncertainty Factor

Election years often bring a heightened sense of uncertainty. The stock market tends to dislike uncertainty because it makes future cash flows (and therefore, valuations) harder to predict. During elections with close races or significant policy divides, the market might show increased volatility, as investors react to every piece of new information. This was evident in years like 2008, where economic and political uncertainties combined to create a turbulent market environment.

This uncertainty factor was clear during the election year of 2020 as well, when COVID-19 brought unprecedented economic disruption. The market initially plunged, driven by uncertainty around the pandemic, but then rebounded sharply due to massive government stimulus packages and investor optimism about economic recovery.

A Look at Market Anomalies

Historical data also shows us a curious market phenomenon known as the “presidential election cycle theory.” This theory suggests that the stock market tends to perform better in certain years of a president's term, with the strongest performance often occurring in the third year. While this theory isn’t foolproof and doesn’t apply perfectly to every term, it does highlight how investor sentiment can shift over a presidential term. During election years, however, the market often reflects immediate political and economic concerns rather than any predictable cycle.

Another anomaly to consider is the “incumbent advantage.” Historically, the market has often performed well in election years where the incumbent party wins. This is likely because a change in administration brings additional uncertainty regarding potential policy changes, whereas continuity offers a sense of stability. Investors might prefer the "devil they know" to the uncertainty of a new administration, even if they don’t agree with all the incumbent’s policies.

What Can We Take Away?

The connection between the stock market and presidential elections is complex and influenced by a mix of economic fundamentals, investor expectations, and political dynamics. Here are a few key takeaways:

Economic Fundamentals Matter More Than Party Lines: The overall economic environment, including factors like business cycles and consumer confidence, often has a bigger impact on the stock market than which party is in power.

Uncertainty and Market Volatility: Election years, especially those with close races or major policy debates, can lead to market volatility. Investors respond to the perceived risk and adjust their portfolios based on expectations of the future.

Short-Term vs. Long-Term Focus: While election years can be turbulent, it’s crucial for investors to maintain a long-term perspective. Historically, the stock market has generally trended upwards despite short-term volatility, suggesting that patient investors who hold through election cycles tend to be rewarded over time.

Insights on Election-Driven Market Dynamics from India and the U.S.

With years of experience in the Indian Income Tax Department and academic training from Columbia and Harvard, I’ve gained a unique perspective on how politics and policy intersect with market behavior. My role in tax administration provided firsthand insight into how public policies shape economic behavior, while my studies in the U.S. highlighted how election cycles influence market sentiment and performance—insights that now inform my analysis of similar trends in India.

The Indian stock market’s volatility during the 2014 and 2019 general elections offers a clear example. Ahead of both elections, markets rallied on expectations of pro-business reforms from the Bharatiya Janata Party (BJP) under Prime Minister Narendra Modi. In 2014, the Sensex rose over 8% before Election Day, and a similar rally occurred in 2019 as exit polls signaled another BJP win, driving both the Sensex and Nifty to new highs. The 2024 elections were similarly under intense global scrutiny, underscoring the significant influence political transitions have on markets.

Insights from a Global Leader: Learning Market Dynamics and Policy Impact from Professor Jan Svejnar at Columbia

During my time at Columbia University's School of International and Public Affairs (SIPA), I had the privilege of studying under Jan Svejnar, the Richard N. Gardner Professor of Economics and International Affairs and Director of the Center on Global Economic Governance. Professor Svejnar’s rich background, including his experience as a presidential candidate in the Czech Republic in 2008, brought invaluable practical insights to the classroom, particularly on how political dynamics, such as elections, impact markets and economies. His expertise spans the effects of government policies on firms, labor, and capital markets, and his lectures seamlessly connected these concepts with real-world scenarios. Through his teachings on leadership and innovative policymaking, Professor Svejnar helped me understand the complex interplay between politics and economic performance. His unique perspectives on governance and market behavior during election periods profoundly shaped my approach to analyzing the effects of political cycles on markets, both in the U.S. and in India.

In conclusion, while the S&P 500’s performance in election years can give us interesting insights into how the market responds to political and economic changes, it’s not a crystal ball for predicting election outcomes or the market’s future. Investors would do well to focus on broader economic indicators and long-term growth trends rather than short-term political shifts. After all, the stock market, much like the presidency, is subject to forces beyond any single individual or party’s control.

No comments:

Post a Comment